how are property taxes calculated in pasco county florida

The median property tax also known as real estate tax in Pasco County is 136300 per year based on a median home value of 15740000 and a median effective property tax rate of. Thank you for visiting your Pasco County Property Appraiser online.

Pasco County Property Appraiser How To Check Your Property S Value

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax.

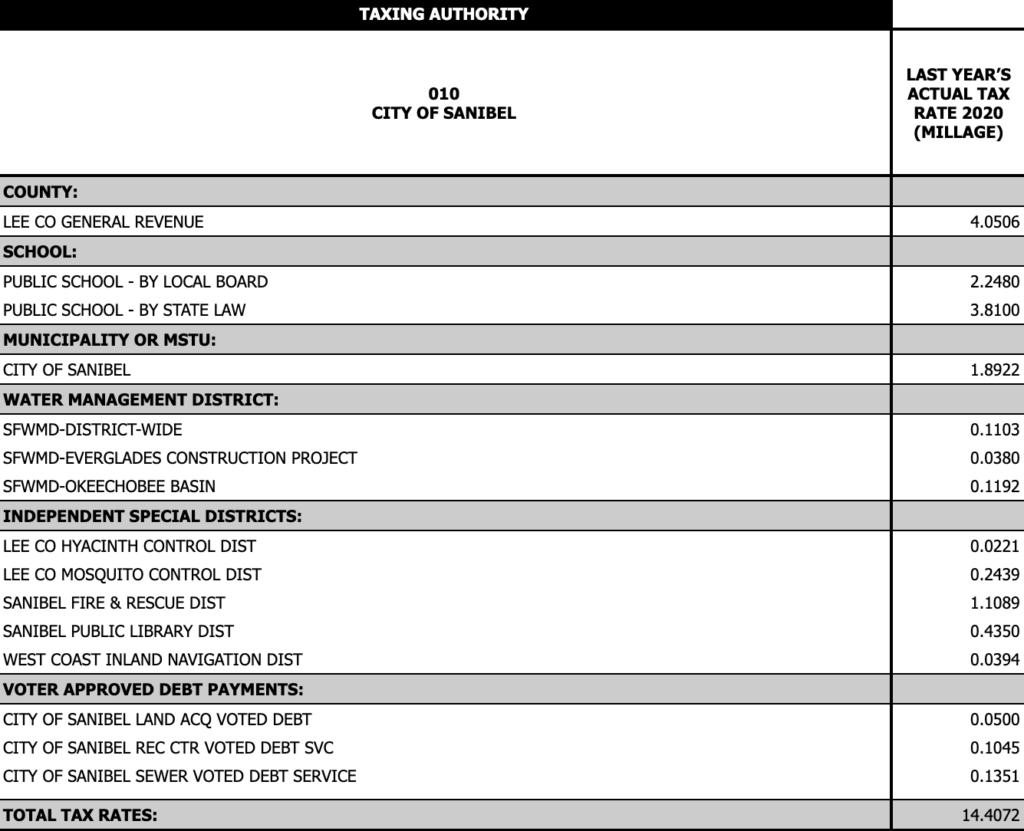

. Assessed Value - Exemptions Taxable Value. Pasco County provides taxpayers with a variety of tax exemptions that may lower propertys tax bill. Pasco County Florida Property Tax Law Find the right Property Tax attorney in Pasco County FL.

The basic formula is. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value.

Electronic Property Tax Notice Receipts. My team and I are committed to exceptional service fairness and accuracy. Business Tax Receipt Information.

The Florida Breast Cancer. Pasco County tax revenue is expected to rise by 876 million. How do I print my real estateproperty.

Pasco County collects on average 087 of a propertys assessed fair. During the month of October the Florida Breast Cancer Foundation will be the featured charitable giving organization at the Pasco County Tax Collectors Office. Money from property tax payments is the cornerstone of local neighborhood budgets.

Along with Pasco County they rely on real property tax receipts to support their operations. Change My Property Tax Mailing Address. SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes.

That money will be distributed throughout various service departments with the sheriff getting 40 percent and the. ALL RIGHTS RESERVED DIGITAL LIGHTBRIDGE. These are deducted from the assessed value to give the propertys taxable value.

All fees are subject to legislative changes. Finally some taxpayers choose to set up an escrow account with their bank which. This simple equation illustrates how to calculate your property taxes.

You can also pay your taxes directly to the Pasco County Tax Collectors Office via mail or in person. Taxable Value x Millage Rate. Please be sure to use the correct calculator for your document type.

The median property tax in Pasco County Florida is 1363 per year for a home worth the median value of 157400.

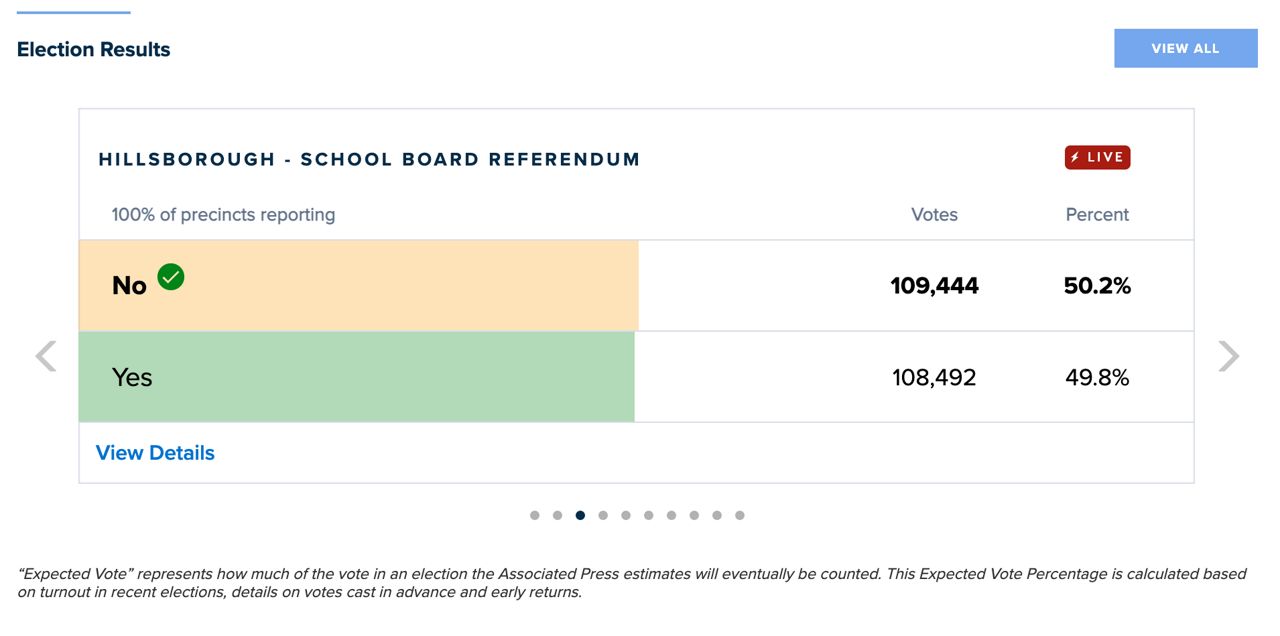

Voters Say No To Tax Increase To Fund Teacher Pay Raise

Florida Property Taxes Explained

Florida Property Taxes Explained

Your Guide To Prorated Taxes In A Real Estate Transaction

What Is Florida County Tangible Personal Property Tax

Aug 23 Voter Guide Property Tax Increase For Duval Schools Jacksonville Today

Pasco County Fl Property Tax Search And Records Propertyshark

Florida Income Tax Calculator Smartasset

Property Taxes Monroe County Tax Collector

Florida Property Tax Calculator Smartasset

Pasco Commissioners Keep Property Tax Rates The Same So Expect A Bigger Bill

Property Taxes Expected To Spike For New Homeowners

Property Tax By County Property Tax Calculator Rethority

Florida Real Estate Taxes Echo Fine Properties

Faqs Pasco County Property Appraiser

How To Calculate Property Taxes The Ascent By Motley Fool

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl